Closing costs are one of the most important costs to consider when buying a house. Simply put, these are the charges incurred when the title of a property is transferred from the seller to the buyer.

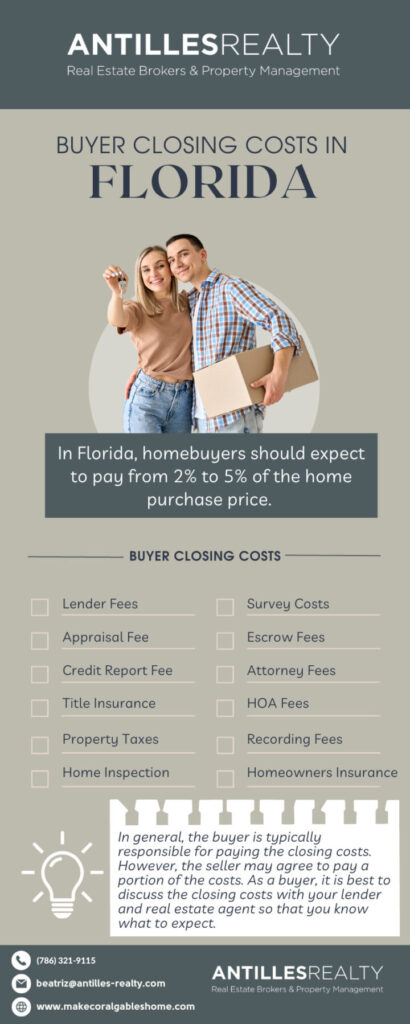

One of the common questions buyers ask is, “How much are closing costs in Florida?” The fees and charges vary depending on the location and the price of the property, but homebuyers should expect to pay from 2% to 5% of the home purchase price.

In general, the buyer is typically responsible for paying the closing costs. However, the seller may agree to pay a portion of the costs. As a buyer, it is best to discuss the closing costs with your lender and real estate agent so that you know what to expect.

This article enumerates the common closing costs in Florida, with a brief explanation and average amount for each expense.

Credit: Image by RDNE Stock project | Pexels

Lender Fees

Lenders charge an origination fee to cover the costs of processing the loan. This fee will vary depending on the lender you work with, ranging from 0.5% to 1.5% of the sales price.

Appraisal Fee

This fee is charged by an appraiser for assessing the value of the property. This appraisal assures the lender that the property is indeed worth the amount they are giving the buyer. The average appraisal fee ranges from $300 to $500. This is often paid by credit card upfront and is not due at the time of closing.

Credit Report Fee

A credit report fee covers the cost for the lender to pull credit reports needed for the buyer and the seller. This fee costs between $25 and $75.

Title Insurance

This provides the new homeowners protection against future claims or defects that might be identified after the sale. The cost for title insurance in Florida is typically less than 1% of the loan amount.

Credit: Image by RDNE Stock project | Pexels

Property Taxes

This is a prorated cost. The seller is responsible for paying the property taxes up until the date of sale, while the buyer will be responsible for paying the taxes from that point onward.

Home Inspection

A home inspection is conducted before closing. This is necessary to know of any major issues with a property, such as structural or foundational damage.

To answer the question, “How much is a home inspection in Florida?” This varies by company and city, but expect to pay around $250 to $600.

Recording Fees

The county where the property is located will charge a fee for recording the deed and other documents related to the home sale. Recording fees range from $50 to $250.

Survey Costs

Many lenders require a land survey of the property to determine its boundaries and the location of any buildings. Survey costs vary depending on the lot size and type of property. Typically, these costs range from $200 to $800.

Homeowners Insurance

This is another prorated cost. The seller is responsible for paying the homeowners insurance until the date of sale, and the buyer will take over from that point on. The average home insurance cost in Florida is $1,981 per year for a policy with $250,000 in dwelling coverage.

Escrow Fees

Escrow fees are paid directly to an escrow company, real estate attorney, or title company for conducting the closing and distributing funds to the third parties involved in the real estate transaction. These fees cost around $500 to $800.

Credit: Image by Kampus Production | Pexels

Attorney Fees

It is optional to hire a lawyer to represent you during a real estate closing. Your attorney fees will depend on your lawyer’s hourly rate and the complexity of the deal. Most buyers choose to work with their real estate agent as they are experienced in the closing process as well.

HOA Fees

The buyer usually pays pro-rated HOA dues once the property has been transferred to them. For instance, if the seller closed the sale on their home at the end of June, and the annual HOA fee is $3,600, then the buyer pays $1,800.

In the state of Florida, the average HOA fees range from $100 to $500.

Credit: Image by RDNE Stock project | Pexels

Conclusion

While closing costs can be overwhelming, especially for first-time home buyers, learning the fees and charges in advance ensures that you have sufficient funds for your real estate settlement.

If you’re considering buying a house in Florida, it’s best to have a reliable realtor by your side, and I’ll be happy to help! Feel free to give me a call today at (786) 321-9115 or send me an email at beatriz@antilles-realty.com so we can start planning for your new home.

Frequently Asked Questions

What is the average closing cost in Florida?

The average closing costs in Florida are about $2,022. This includes costs such as loan origination fees, title insurance, and property taxes.

What is the role of a title company in closing costs?

A title search company is responsible for verifying that the title of the property you are buying is clear and free of any liens or other encumbrances.

Are there any first-time homebuyer programs that can help with closing costs?

Yes, there are several programs for first-time homebuyers in Florida. Those who qualify for 30-year, fixed-rate conventional mortgages will benefit from lower mortgage insurance costs and may combine these with a down payment and closing cost assistance program.

Can I negotiate closing costs in Florida?

In most real estate transactions in the state of Florida, buyers and sellers share the closing costs. While buyers cover most of these fees and charges, you can negotiate with the seller for concessions.

Do closing costs vary by location in Florida?

Yes, closing costs vary depending on where the property is located, the home you’re buying, and the companies you work with.

Is it possible to roll closing costs into the mortgage?

Yes, this is possible through a no-closing cost mortgage. With a no-closing cost mortgage, your lender will be the one to pay for the initial closing costs and fees. In exchange, you will have to pay a higher interest rate over the lifespan of your loan.

Some buyers opt for a no-cost mortgage so they can use more of their money towards a down payment. Keep in mind, though, that while this can help you save money in the short term, you will have to prepare for increased monthly payments and higher interest rates for the long term.